Rep. Patrick Tiberi [R-OH12], on Oct 6, 2011, proposed HR 3123, the American Job Creation and Investment Act of 2011. The title may imply the bill will have some meaningful efforts to promote job creation, but when you read the bill’s description, you’ll quickly learn it has nothing to do with job creation and everything to do with allowing “bonus earners” at the top of the food chain to avoid paying AMT on those exorbitant bonuses.

The Alternative Minimum Tax (AMT) was designed to keep wealthy taxpayers from using loopholes to avoid paying taxes. But because it’s not automatically updated for inflation, more middle-class taxpayers are getting hit with the AMT. This bill, should it be enacted, will only exacerbate the disparity in taxable income, giving the Wall Street bonus earners yet another tax advantage under the guise of “job creation.”

According to THOMAS, HR3123, the American Job Creation and Investment Act of 2011, would amend the IRS code, with respect to the election to accelerate the alternative minimum tax (AMT) credit in lieu of bonus depreciation, to: (1) repeal the $30 million cap on the AMT tax credit and increase the rate of such credit from 6% to 50%, (2) allow investments made by partnerships that are more than 50% owned by a corporation to qualify for such increased AMT credit amount, and (3) allow taxpayers to make separate elections for each taxable year to take bonus depreciation or AMT credits in lieu of bonus depreciation.

I oppose such a change in the IRS code and as such, I used POPVOX to send an email to Rep. Amodei expressing that opposition on 12/8/2011:

“I oppose the passage of H.R. 3123, titled as the “American Job Creation and Investment Act of 2011.” The writer of this bill was apparently tapped by the GOP tax fairy’s wand and is under the delusion that tax cuts (in the form of elimination AMT revenue) are free, and that merely by decreasing taxes, multitudes of jobs are created. That’s simply NOT the case! Additional job opportunities are created when demand for products/services increases beyond the capabilities of the employer’s given workforce. The only thing this bill will do is deprive the Treasury of needed revenue. Little, if anything, will take place with respect to job creation, since nothing in this bill is designed to create additional demand for products and/or services.”

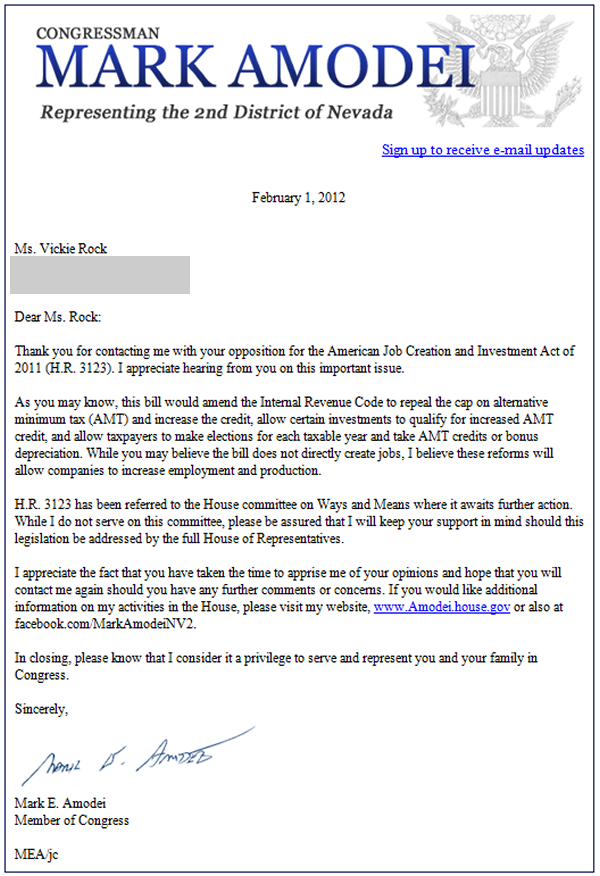

Today, I got his reply to my email:

HR 3123 is an affront to tax fairness and opens a window into the GOP’s desire to “take our country back” … apparently to before 1969. You see, it was in 1969 that Congress noticed that 155 people with high incomes were legally using so many deductions and other tax breaks that they were paying absolutely nothing in federal income taxes. Their nonexistent tax bills were an embarrassment. So … Congress instituted the AMT with the aim of making the tax system fairer.

But because the AMT was never indexed to inflation—as the regular income tax is—each year, more and more middle-income taxpayers are snared by a tax originally targeted at the rich. Each year, instead of indexing the AMT, Congress merely applies a “patch” in an attempt to slow down the expansion of the AMT to taxpayers to whom it was never intended to apply.

The patch HR 3123 would hope to apply would trounce all over the fairness in taxation principle that the AMT was originally designed to assure.

Does he not understand what you were saying? He will “keep your support in mind”? He really is CLUELESS!

Whoever is responding on his behalf apparently doesn’t understand that “opposition” does not equate to “support”. This isn’t the first letter I’ve written in “opposition” only to have the responder claim that Amodei will” keep my support in mind.”