Read and Search the Full Mueller Report

Mueller Report by on Scribd

Mueller Report by on Scribd

Attorney General Barr Deliberately Distorted Significant Portions Of Special Counsel Mueller’s Report APRIL 18, 2019 Washington, D.C. – Today, House Speaker Nancy Pelosi and Senate Democratic Leader Chuck Schumer released the following joint statement. “What we’ve learned today is that Attorney General

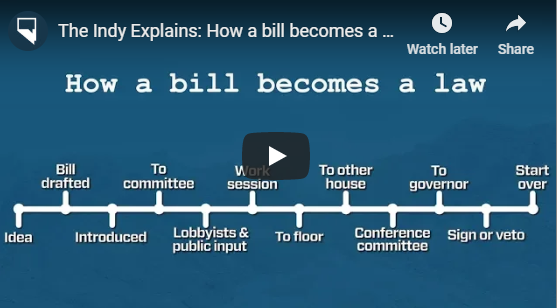

— by Speaker Jason Frierson Last week we made progress on many different bills, including a number of our blueprint priorities. Two of these are highlighted below. This week is another important deadline here in Carson City, with bills needing to be

Have you ever wondered what it takes to get a bill passed via the Nevada Legislature … from idea to Governor’s signature. Thanks to the Nevada Indy, we now have a video that explains the entire process.

This morning, I received an update on the status of the National Popular Vote initiative. It’s a long update, but well worth the read. Here it is: There’s new momentum around the National Popular Vote movement, where states will award Electoral College votes to

There are six statewide ballot measures to consider. Two are constitutional amendments which were previously approved by the voters in 2016. Nevada state law requires that a measure be passed two times, in two even-numbered election years to become a state constitutional amendment. Question 1

— by Mike Harlos For almost a bit over a year now, I’ve completely avoided political posts. Today, I took a break from that. Tornillo, TX is on the US/Mexico border. There is a “tent city facility” setup there. The facility is housing

Given this letter from Mr. Trump to Kim Jong Un: I wonder what the White House is proposing that we do with this waste of our taxpayer dollars now that no summit will be taking place?

[embeddoc url=”http://www.humboldtdems.com/wp-content/uploads/2018/05/2018-SampleBallot.pdf” download=”all” viewer=”google”]